With the start of the school year looming, Texas is gearing up for its annual Sales Tax Holiday, a tradition since 1999. This year, the tax-free weekend kicks off on Friday, August 11th and will last until midnight on Sunday, August 13th. During this period, Texans can enjoy no state or local sales tax on numerous school supplies, along with most clothing and shoes priced below $100. For those considering long-term payment plans, lay-away options can also benefit from the tax holiday.

The specifics remain consistent with previous years. Clothing and footwear under $100 are exempt from sales and use taxes. Additionally, backpacks priced under $100, aimed for use by elementary and secondary students, are exempt. This includes wheel-fitted backpacks that can be traditionally worn on the back and messenger bags. However, items such as luggage, briefcases, athletic/duffle/gym bags, computer bags, purses, and framed backpacks are not included in this exemption.

Furthermore, the tax break extends to most school supplies under $100 intended for elementary or secondary school students. There’s no need for an exemption certificate for these holiday purchases unless the items are being bought under a business account. In such cases, the retailer should obtain a certificate from the buyer to confirm the supplies are for elementary or secondary school students.

For those planning their shopping, the Comptroller’s website offers a detailed list of tax-free items, available under the Sales Tax Holiday section.

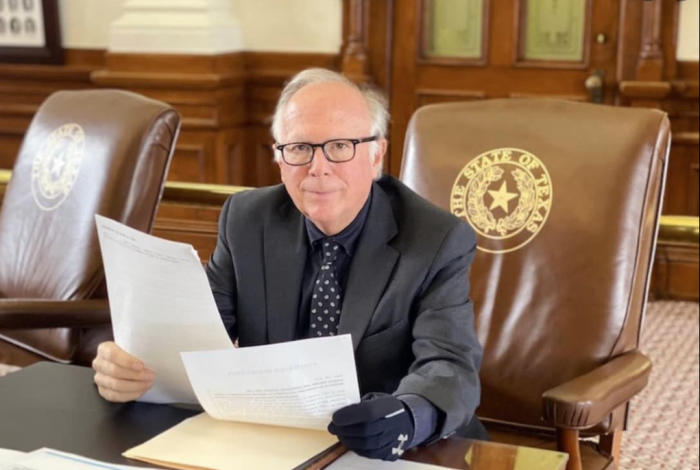

Should there be any queries regarding this Sales Tax Holiday, the Capitol and District offices are always ready to assist. Reach out anytime with questions, feedback, or if you need assistance with Texas state agencies or constituent services. You can contact Todd Hunter at todd.hunter@house.texas.gov or call his offices: Capitol Office at 512-463-0672 and District Office at 361-949-4603.